The Reserve Bank Board meet tomorrow with all major lenders and many analysts predicting a cut to the official cash rate. Whether this happens tomorrow or not it’s universally accepted that rates will drop this year, by exactly how much and when still depends on several factors.

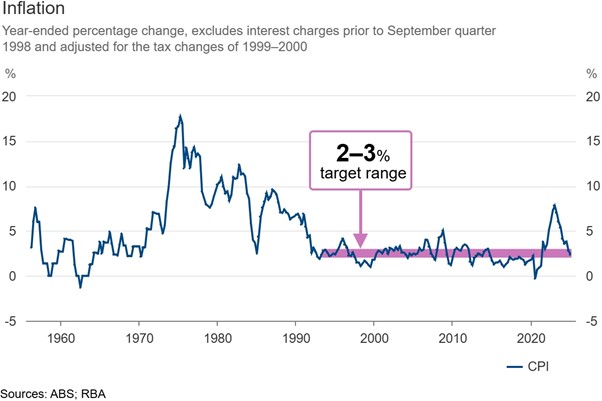

The continues resilience of the labour market with unemployment rate sitting at 4% will be a key consideration although both headline inflation and underlying inflation have been trending downward and importantly headline inflation is now sitting in the Reserve Bank’s target band of 2-3% currently at 2.4% seasonally adjusted.

The effects of an upcoming interest rate cut on different housing markets will not be uniform across Australia. Head of Research at CoreLogic – Eliza Owen notes that certain areas, particularly Melbourne and, to a lesser extent, Sydney, may experience more significant benefits due their property markets having previously peaked over a year ago.

In anticipation of the expected rate drop these markets have already seen an uptick in investor activity in the new year. In contrast, the markets of Adelaide, Brisbane, and Perth are currently at or near their peak and have already reported a drop off in investors in their respective markets since late last year.

Overall, while national dwelling values are projected to rise, the impact of the rate cut has historically varied across different regions.

Certain sectors are likely to benefit more significantly from these reductions due to distinct market characteristics, such as price points, location, and investor interest. While some markets may experience a substantial boost, others may only see a modest uplift, reflecting the uneven nature of the real estate landscape.

Furthermore, the increased borrowing capacity should attract more buyers to either enter the market or look to use the increased servicing as leverage for further property. Overall, the expected interest rate cuts are poised to influence buyer behaviour and market dynamics across different regions. Whilst there’s much anticipation surrounding tomorrow’s RBA decision with the shortest odds of a rate cut in years it’s interesting to see that the savvy investors are already starting to move their money where there’s more upside predicted.

Andrew Black

With over 15 years of experience in the property industry, Andrew Black has built a stellar reputation as a trusted leader and expert.